Samsara

/Overview

Samsara is an Internet of Things startup that offers a cloud platform solution for industrial sensor data. Their focus is on providing real time analytics and ease of analysis for industrial sensor system across a number of industries. Their product team is focused on a complete solution for their customers so they design the software, hardware, and necessary network infrastructure all in house.

Their in house designed sensor systems (no OEMs) focus on ease of deployment and provide the cloud backend so that their sensors drive meaningful improvements once installed. Sensors to date include cameras, GPS systems, temperature gauges, environmental sensors, electrical power monitors, etc.

The firm was founded in San Franciso in early 2015 and is currently around 100 employees. It's cofounders, Sanjit Biswas and John Bicket, are successful serial entrepreneurs who previously sold cloud networking company Meraki to Cisco Systems for $1.2B.

Why I like Them

I 100% agree with Marc Andreessen's belief that within 20 years every physical item will have a chip in it and a wireless antenna. Samsara is at the forefront of this wave with their focus on ease of deployment and making the data these items provide digestable and usable by the end customer. The team is extremely focused on a plug and play model that offers a complete solution to industrial sensor users, many of which are industries that have not seen as much software automation as you'd expect.

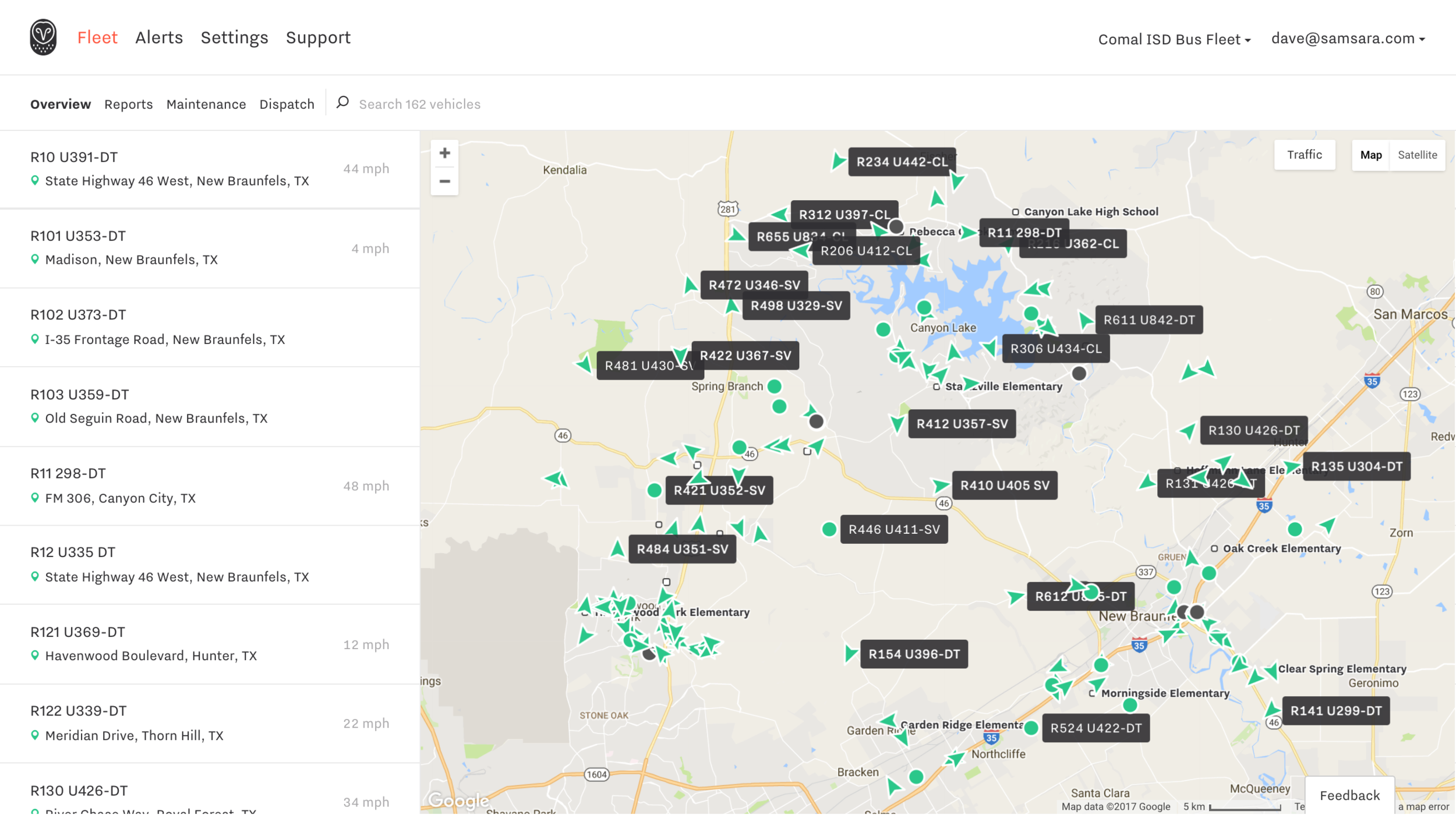

Most of Samsara's business currently comes from logistic and transportation fleet tracking. An example use case in this market is that the company immediately knows if one of their trucks has had an accident as well as track in real time the position, fuel efficiency, etc of a fleet of thousands of vehicles. Reports from the team are that their product is a relatively easy sell to dispatch services and fleets.

Beyond the above I am also very excited about the potential applications of Samsara's cloud platform across many other industrial sectors. It is easy to see how this product could be used across the food industry's cold chain to monitor produce conditions from the farm all the way to the checkout line in the grocery store. Also, traditional manufacturers of physical goods can easily use this type of technology to monitor products during a manufacturing process, warehouse storage, and transportation.

By all reports their latest $40M in venture funding in June 2017 was driven by investor demand, not by a strong need by the company.

Fleet Tracking Overview Page of Samsara's cloud platform

Disclosure: I have spoken briefly with members of the company's product team.